Farthinghoe and Whisky

Our conversations in the whisky world have been long and are ongoing. Aware of some of the less scrupulous operators out there we sought to get involved when it made sense for you, our clients. In an industry that often works in decades, not years, patience is key. We have timed our entry into the market at the bottom of the cycle in conjunction with our new platform to offer a bespoke and end-to-end service, with great access, pricing and opportunities for exit.

We have worked hard over the past few years to build the required relationships to ensure we are offering casks of the best provenance from distilleries that rarely, if ever, release stock and whose mature bottles can command four-, five- or six‑figure prices. Our strategy was to align these nurtured relationships and access with our new website platform providing the proper oversight, handling and potential exit strategies for our clients. We feel entirely confident offering you whisky casks of this ilk, and can get behind these wonderful barrels of golden liquid.

Extending 50 Years of Expertise

Offering whisky casks isn’t a departure from our core; it’s an extension of the expertise and integrity that have underpinned Farthinghoe’s wine business for 50 years. We’re bringing the same due diligence, transparency and enthusiasm to whisky so our clients can diversify their collections and savour the very best of Scotland’s (ie, the world’s!) top distilleries.

Much like fine wine, whisky gains complexity and value with time; the numbers from our recent offers show projected returns of 16-21 % per annum and final values that dwarf the initial outlay. Yet we believe the pleasure of owning a cask must match the investment case, and can also provide an opportunity to bottle and drink some. Each cask we source is chosen for character and provenance, whether it’s the maritime, briny intensity of Campbeltown or the smoky elegance of Port Ellen’s last vintage.

Legal Ownership You Can Trust

A key part of this has been ensuring we were entirely comfortable with the legalities of ownership. We make CERTAIN the cask you purchase is legally your property. Some operators will give a certificate of ownership but it doesn’t carry legal weight. We will provide you with a ‘Delivery Order (DO)’ and an invoice, which when combined, show the cask belongs to you.

The DO is a document for HMRC detailing the cask number, distillery, year of fill, ABV and Litres of pure alcohol, known as OLA (Original Litres of Alcohol on younger casks) or RLA (re-guaged litres of Alcohol, on older casks). The DO is, in effect, a fingerprint for your cask, formally registering you as the owner for HMRC purposes.

Why consider whisky as part of your cellar?

Whisky is not a replacement for traditional investments - but like fine wine, it can sit comfortably alongside equities and property as part of a broader portfolio. When carefully selected, a cask of single malt offers three key attractions:

Finite by nature - once a cask is bottled, that parcel of whisky can never be repeated.

Global demand - Scotch, and especially single malt, has a huge, knowledgeable, and enthusiastic following across the globe.

A tangible, titled asset - you own a specific cask held in bonded storage in your name, rather than a derivative or pooled scheme.

Why Now?

Premium whisky markets have softened a little in the last couple of years, which makes entry levels more interesting than at the very top of the cycle. At the same time, rare whisky indices over the past decade have shown strong compound growth.

Independent data shows that rare whisky has been one of the better performing luxury asset classes over the last ten years, although that rate of return is unlikely to continue in a straight line. There are also structural tailwinds. A new free trade agreement with India, one of the world’s largest whisky markets, is expected to reduce tariffs on Scotch from 150% to 40% over the coming decade, which we expect to support long term demand.

How a Whisky Investment Typically Works

Selection

Acquisition

Maturation

Exit

Exit Routes - How Value is Realised

Selling In Bond

You can sell the cask while it is still in bond to another person or company. We can help broker this on your behalf.

Sell to Independent Bottlers

When a cask reaches certain levels of maturity, there will be opportunities to sell entire or part casks to independent bottlers.

Sell in stages

After maturing for a time, you can re-cask the whisky, keeping a portion aside to bottle and selling the remainder in bond to continue maturing. This lets you realise some value while still retaining exposure.

Bottling to sell

You can bottle the cask and sell the bottles yourself, or via merchants and brokers. Bottling and labelling introduce extra costs, which we help you factor into the decision.

What Kind of returns are realistic?

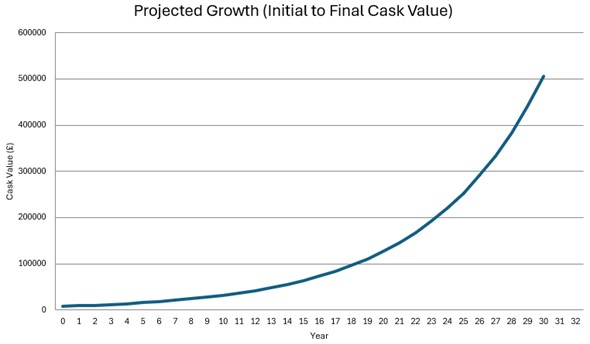

For each cask we prepare a full illustration rather than headline figures. We use current bottle values, storage and insurance costs, and a central assumption of 5% annual growth in bottle prices and 3% consumer price inflation.

These assumptions are deliberately conservative compared with some long-term rare whisky indices, but they still show how powerful compounding can be over twenty to thirty years.

Illustrative example (not a forecast)

To give a sense of how this works in practice:

Cask: Caol Ila 2023 barrique

Initial cask cost: approximately £8,000

Holding period: 30 years (to age 32)

Assumptions: 5% annual growth in the real bottle price, 3% annual consumer price inflation, Allowance for long-term storage and insurance costs

On these assumptions, the projected cask value after 30 years is a little over £500,000, equivalent to around 15% a year compound before tax.

These are illustrations, not promises. Actual outcomes will depend on:

the future desirability of each distillery and style, broader market conditions, and the timing and route you choose to exit.

How Farthinghoe Approaches Whisky Investment

Our background is in sourcing, managing and eventually exiting fine wine collections for clients. We apply the same discipline to whisky.

We aim to:

Offer a small number of casks from respected distilleries rather than chase every new release. Be transparent about all costs, assumptions and projected outcomes, and think about exit routes from the start, so that decisions made today still make sense in twenty years’ time.

We can arrange storage in our recommended Scottish bonded warehouse, all visible through your online portfolio as your wine is or, if you rather, you can set up your own storage account and have it transferred there to manage yourself.

We would love to talk you through this process, explain the structures as well as making sense of these acronyms, laws and distillery profiles.